The Unit Root

Eurodollar University

Shownotes Transcript

The bread of this podcast hotdog features Jeff Snider putting into context how far behind the times monetary authorities are, and that all may not be as it seems with the appreciating Chinese currency. But the middle, the wiener if you will, is about the unit root. But please! Before you throw your device across the room in disgust rather than listen to yet another podcast about monomial equations and non-stationary processes realize that it's all about econometricians assuming economies do not suffer permanent shocks. The assumption that an economy must experience a recession AND a recovery.

A 1993 paper by Milton Friedman averred the data showed this is how economies operated, and indeed they did -- in the post-WW2 experience. Friedman referenced an earlier work of his, from 1964, with data that stretched over a longer period that ALSO showed this. And indeed, the 1879 to 1961 period does, as long as you exclude the war cycles and 1945 to 1949 because, as Friedman put it "of their special characteristics." So, if your podcaster understands this correctly, if you exclude permanent shocks and data discontinuity then one is welcome to assume no permanent shocks.

Now, your podcaster is admittedly missing something here. For one, he's missing econometricians' razor-sharp intelligence. Second, he hasn't won a Nobel in economics - not yet at least. The cost of this lacuna is that shoelaces give him trouble - all his trainers and loafers have Velcro. Simultaneous gum chewing and walking results in emergency trips to the dentist. And hot dogs are eaten with the bun in one hand and dog in the other. But the benefit of not having a towering intelligence is not falling prey to hubris. In believing intricate mathematics model out permanent shocks. In believing that it can go back to the way it was. The year 2008 was a permanent break. Like 1914. Like 1929. Like 1945.

----------WHY----------PART 01: How many years behind are regulators, from the leading edge of money? Consider, seven years AFTER the crisis, Europe introduced legislation (2014) to track securities lending. Not until 2020 did data collection begin. Besides, this, and other, money activity was brought to our attention in 1981!

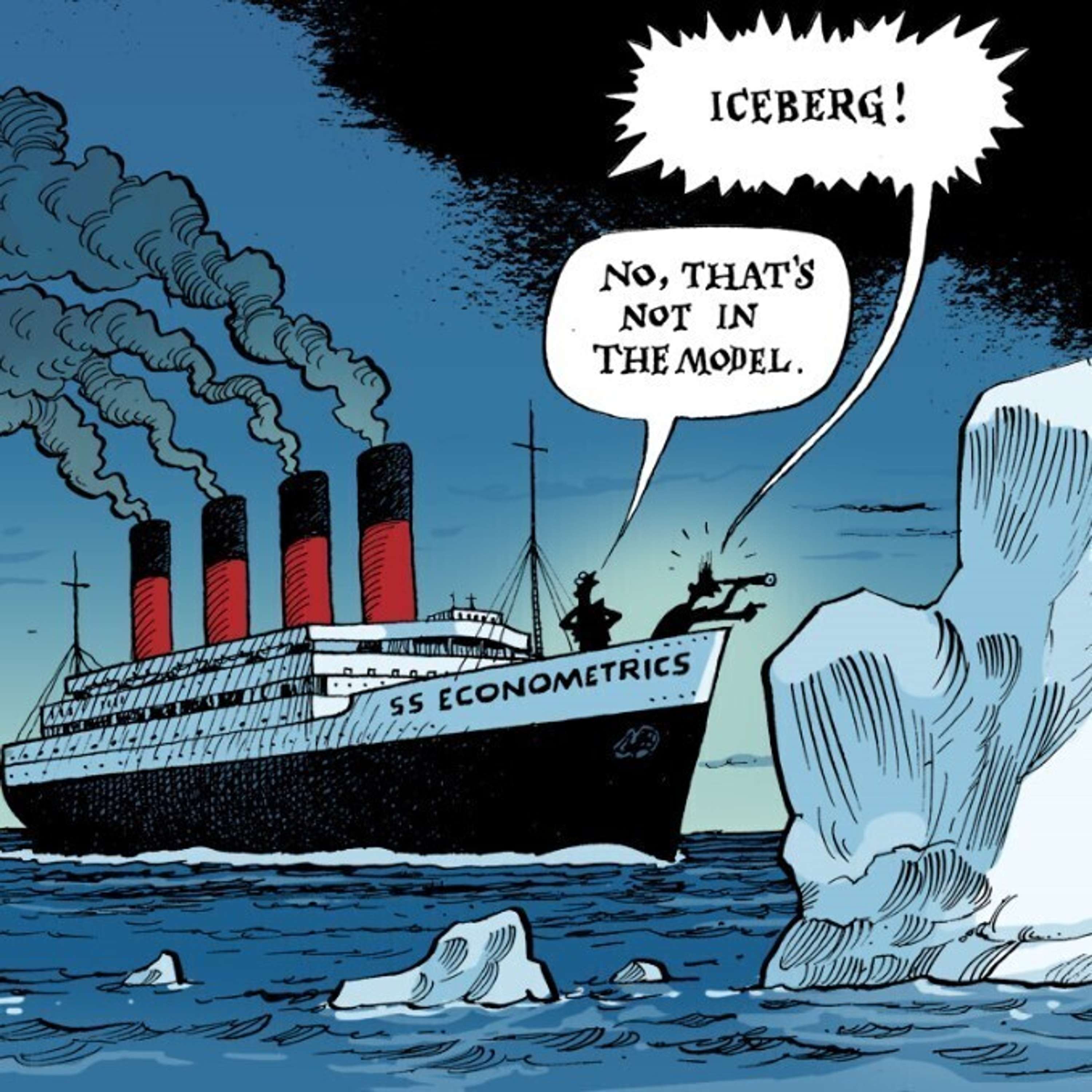

PART 02: The world is complex. Too complex to model. Assumptions must be made. Is the exclusion of permanent shocks to the economy a reasonable one? Rational? Plausible? Yet econometricians -- with their hands on the wheel -- say it is. That iceberg dead ahead? Not in the model.

PART 03: The Chinese currency is gaining against the dollar. That SHOULD be an 'all-clear' signal that reflation, global trade, and positive momentum are in place. But we DO NOT see corroborating evidence on the People's Bank of China balance sheet. Maybe the move is an engineered feint?

----------WHERE----------AlhambraTube: https://bit.ly/2Xp3royApple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKPodcastAddict: https://bit.ly/2V39Xjr

----------WHAT----------Central Banks Trying to Create Inflation Is An Old Laugh Line: https://bit.ly/35uS5CrInnovation in the International Financial Markets by G. Dufey and I. Giddy: https://bit.ly/2HDEpNDThe Unit Root of the Missing Monetary Monomial: https://bit.ly/37zvVBVMilton Friedman's 1964 The Monetary Studies of the National Bureau: https://bit.ly/3dQquQ2Milton Friedman's 1993 "The Plucking Model of Business Fluctuations Revisited": https://bit.ly/3dQ1OY3CNY + TIC = October 2020, or 2017?: https://bit.ly/2FTp2Qk

----------WHO----------Jeff Snider), Head of Global Investment Research for Alhambra Investments with Emil Kalinowski), an innuendo. Artwork by the unit root, David Parkins). Podcast intro/outro is "Siren Screen)" by Ooyy) at Epidemic Sound).