Decade of Disorder? It's "Transitory"!

Eurodollar University

Shownotes Transcript

How much is several? What is a few? If you were to put a numerical value on "probably" would it be more, or less, than "likely"? To your podcaster's great consternation the linguistic gatekeepers of Middle English appear to have been rather disinterested about it all. And so, people are constantly late... or early! 'I thought we were to meet in a few hours?' 'No! It was several.' 'Oh, right.' Women seem to revel in these nuances, arriving for a date with this podcaster when it pleases them and then claiming etymological immunity.

Which brings us to the word transitory. Admittedly there is SOME lexicographic nuance: momentary, transient, impermanent, temporal. However, the Federal Reserve - like the proverbial camel - stuck its thesaurus-nose into that nuance and CHARGED into the economic-tent of the past decade. Why did the 2009-10 Green Shoots recovery fail? Transitory European Sovereign Debt Crisis, gummed Bernanke. Why did the economy swoon in the first quarter of 2014? Transitory Polar Vortex, chomped Yellen. Why did inflation not accelerate despite 'full-employment'? Transitory cellular data-plan price war, gnawed the FOMC. Why was Globally Synchronized Growth tripped up? Transitory political trade wars, chawed Powell.

So here we are, 10 transitory-filled years later. Now, unless there are glaciers listening to this podcast - and it needs all the ratings assistance it can get - it's likely the audience is in unanimous agreement that the definition of "transitory" has been tortured to death. Indeed, the Federal Reserve agrees! And Transitory has been retired. Or cremated. Still, instinct informs your podcaster that much like our zombie economy, the excuse is undead and Transitory will walk again!

----------WHY----------PART 01: A great improvement in the US unemployment rate (JUL: 10.2%, AUG: 8.4%) suggests the Reopening Boom hints at economic recovery. UNFORTUNATELY, we have heard this story before -- indeed, for over a decade. Other employment data imply the unemployment rate is unreal. AGAIN.

PART 02: Capital market seasonality is popularly assumed to be a phenomenon of the past; a quirk of an agricultural, bygone era. Not true! They still exist. And the calendar's biggest capital market bottleneck is dead ahead: September.

PART 03: Why didn't the economy recover by 2011-12? Transitory issues in Europe. Why didn't the economy boom? Transitory weather. Why didn't good inflation materialize? Transitory price wars. Sadly what's not transitory is the seriousness with which central banks are taken.

----------WHERE----------AlhambraTube: https://bit.ly/2Xp3royApple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYCastbox: https://bit.ly/3fJR5xQBreaker: https://bit.ly/2CpHAFOPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaSoundCloud: https://bit.ly/3l0yFfKPocketCast: https://pca.st/encarkdtPodcastAddict: https://bit.ly/2V39Xjr

----------WHAT----------Unfortunately Like Old Times: Back To Being The Star of the Payroll Show: https://bit.ly/3hglpAIEven More Suggesting Something Did Happen In July: https://bit.ly/2Fu7uJUCOT Black: Closing In On Mid-September, What About Oil?: https://bit.ly/3mhs9BRBottleneck In Japanese: https://bit.ly/3hof06BNew York Clearing House Banks Monthly Movements of Cash to and from Interior (1905-1908): https://bit.ly/3hsLYCK A Deflationary Mindset That Isn't In Our Minds: https://bit.ly/2FyXJdO

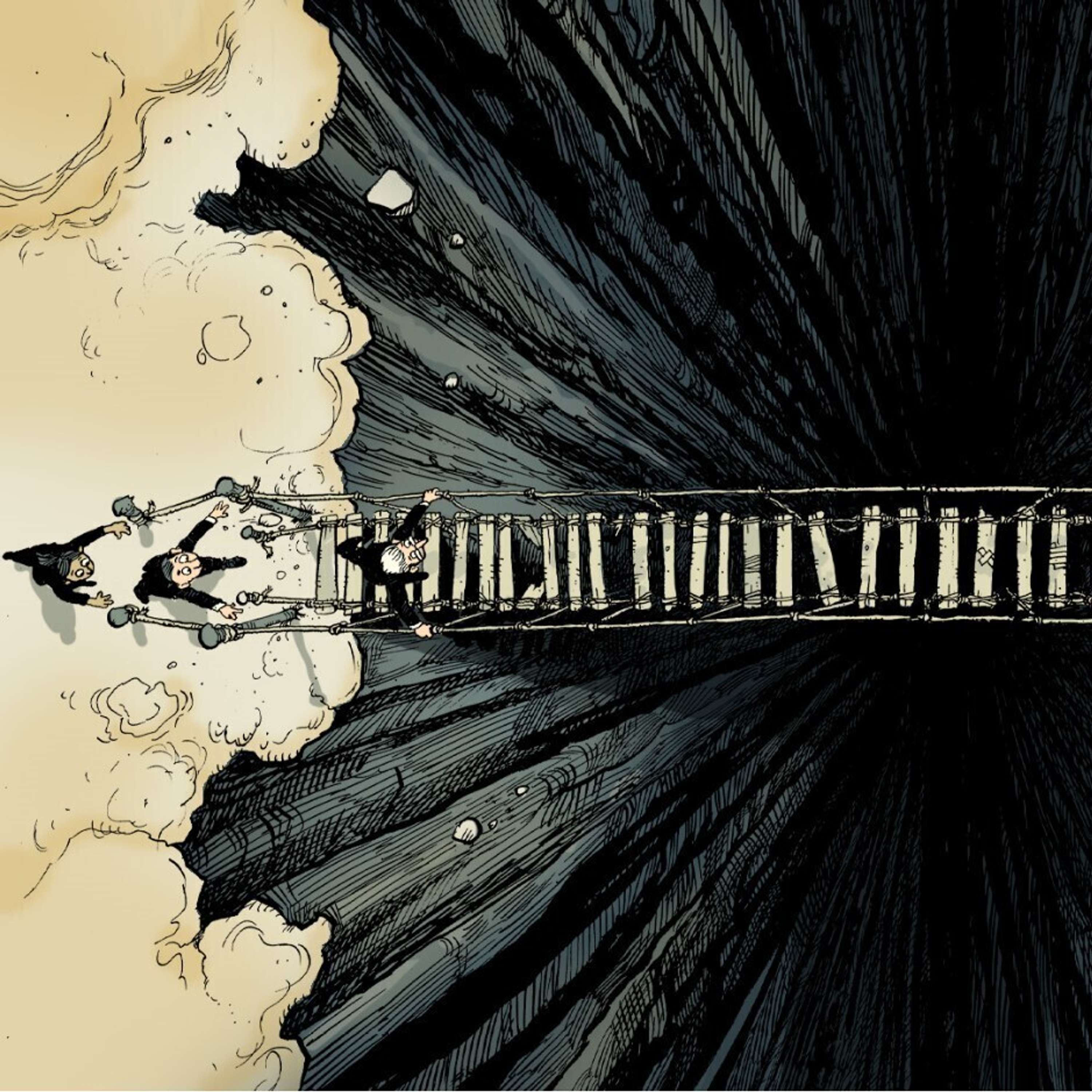

----------WHO----------Jeff Snider), Head of Global Investment Research for Alhambra Investments with Emil Kalinowski), who has no idea if it is safe. Artwork by "Marathon Man" David Parkins). Podcast intro/outro is "Moonline)" by Cushy) at Epidemic Sound).