The Critical Technology in Finding Critical Materials

a16z Podcast

Deep Dive

Shownotes Transcript

There is a phrase that's common in the mining world, which goes something like, "If you can't grow it, you must mine it." That's so central to understand that so much of our physical world around us, our homes, our cars, everything on our tabletops, these things require materials that must be mined from the Earth's surface and below.

That is Connie Chan, a 16Z general partner. Connie has led investments into all kinds of companies, from live shopping to religious super apps to AI leasing agents. But one of Connie's most important bets isn't your standard technology story. It's in a mineral exploration company, one that uses artificial intelligence, but also human intelligence, to find critical materials across five continents.

Now for many of you, this is a topic that is just starting to bubble up because if you want to build the future, so many of the new technologies that we're talking about and dreaming about are going to require more metals. One very clear example is for electric vehicles. EVs require massive batteries and those batteries need more copper, more lithium, more nickel. And there's very clearly a big supply gap that's coming in a couple of decades.

EV cars right now globally account for already 14% of car sales. In China, it was the majority of car sales in 2024. And these EVs require 4x the amount of copper as a normal gas vehicle. So if we want to power this green revolution, we definitely need more mining.

And it's not just electric vehicles. If you think about data centers, BHP estimates by 2050, we're going to have 6 to 7% of the world's copper going directly to data centers. Now you might say, well, 2050 sounds so far away, but the reality is it can take years to find the mine, years to find the deposit.

Years to then estimate the size of the deposit, figure out how to extract it best. Then years to build out the mine and then decades to actually extract all of that metal, which means if we need more metal in one, two, three decades, we have to find that metal today. So as this topic moves to the forefront of not only the technology conversation, but the national conversation, we brought in three guests from all over the COBOL team.

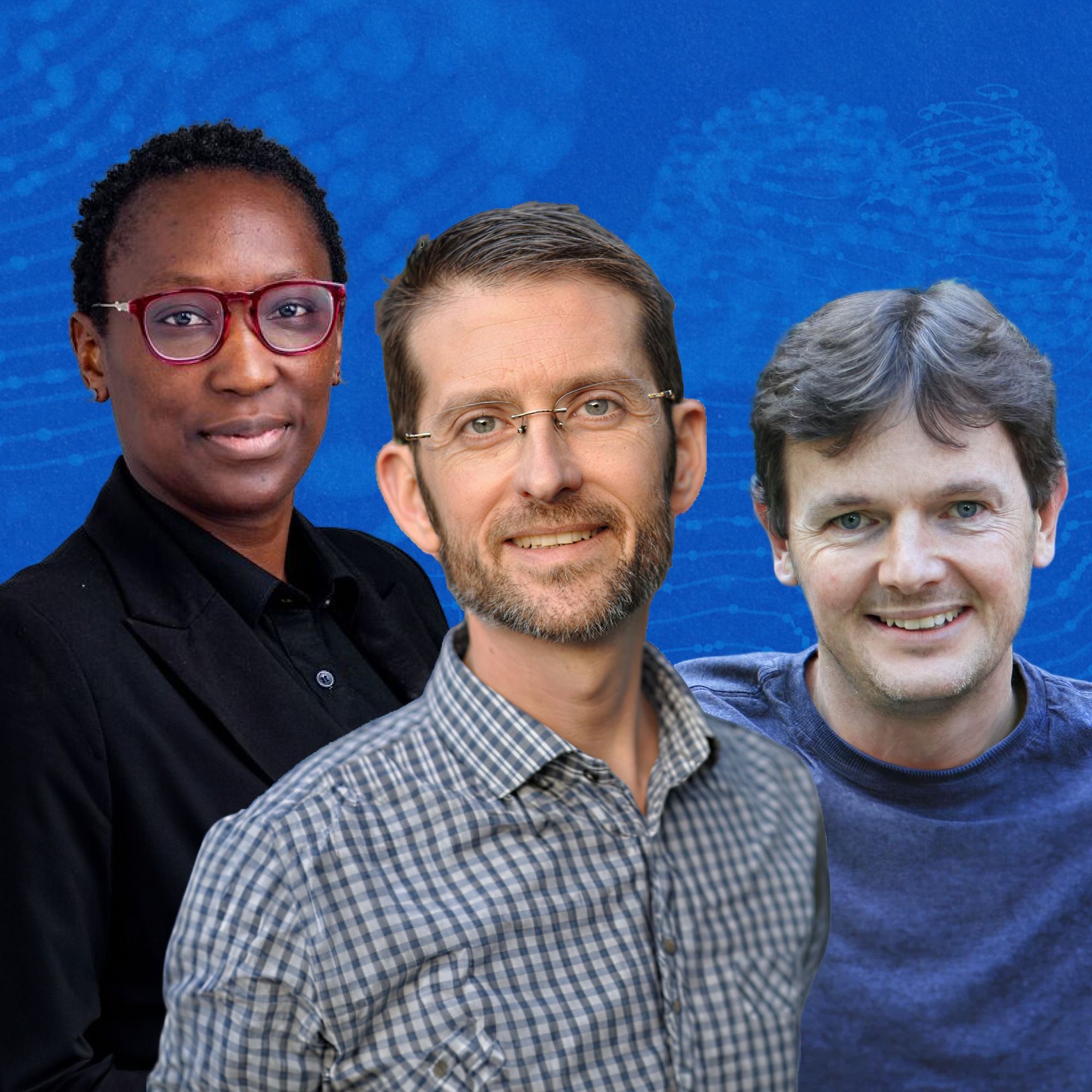

Tom Hunt, VP of Technology at Cobalt. My whole career has been at the junction of technology and climate change. My name is Mfikei Makai. I am Zambian and I'm a trained mining and civil engineer. I've been in the industry for a little over 16 years. Hi, George Gilchrist, VP of Geosciences for Cobalt. Geologist here in Johannesburg, South Africa.

Tom, MVK, and George have worked in a combination of projects, from solar printing to working in existing mines. And in today's episode, we explore what makes these metals truly irreplaceable, the current process for discovery, how technology and data are changing the game, plus how to decide when to drill when. The single drill hole can cost up to a million dollars. So without further ado, let's get started.

As a reminder, the content here is for informational purposes only, should not be taken as legal, business, tax, or investment advice, or be used to evaluate any investment or security, and is not directed at any investors or potential investors in any A16Z fund. Please note that A16Z and its affiliates may also maintain investments in the companies discussed in this podcast. For more details, including a link to our investments, please see a16z.com slash disclosures.

To kick off, I'd like to talk about why are these metals so critical? For the energy transition, we will need to build about 2 billion electric vehicles, which means that we actually have to discover about a thousand new mines in order to provide the lithium, nickel, copper, and cobalt that's going to go into those vehicles.

After we've built those vehicles, we can recycle the batteries, but we need to put the batteries into those cars to begin with. So there is no substitute for copper or lithium. Copper is the second most conductive metal after silver. And unless we find an enormous pile of silver, we're going to be using copper long into the future.

Lithium is both the lightest element and the most electronegative element. And having worked on next generation batteries, there's really no substitute for the energy density you can get out of lithium. So these metals are irreplaceable in the global supply chain for the energy transition. And they're also critical for the build out of solar, of utility scale batteries, of all kinds of new power generation, as well as the next generation data centers.

So there's no shortage of demand when it comes to these critical metals. What is the main problem that we're trying to solve, though? Is there a shortage of supply? Are these metals rare? Are they very difficult to find? There's plenty of metal in the Earth's crust. And the question is, how do we find places where

the history of the earth has concentrated these metal deposits to the point where we can extract them both cost effectively and with minimal environmental impact. So the more concentrated a metal deposit is, the less rock you have to process in order to extract a certain amount of metal. You

You talk about how these metals are not that rare. Does that mean we can find them in our backyard? Should we be searching for it locally, domestically? Where do these metal deposits usually live? Yeah, I think my kids and my neighbor's dog certainly try to look in my backyard for metals, but they don't concentrate in very many places. There's a very unique combination of factors that are required

to concentrate any of the metals into a small mineable target. And these will vary depending on what you're looking for. So one of the tricks in exploration is to really become super familiar with the deposit style that you're targeting to understand where these controls are coming together. So if you're looking for copper, it might be in a very different place to where you might be looking for lithium.

The techniques that you use are different. Even within copper, there will be different types of deposits that will have very different characteristics and require different tools, different approaches. You have to be really flexible. There's no formulated approach to making a discovery. The question now is, can we do it faster or more effectively than we have been? Can we use more of the data that we have at our disposal to guide those decisions and to really

help identify where the most prospective areas are. And cobalt goes around the world to find the best rocks. We go to the high Arctic, if that's where the geological conditions for our formation were best. And the Central African Copper Belt is one of the best copper locations in the entire world, which is why we're there. So give me a sense, what does it mean to be high grade or low grade? Copper is quite a stark example.

Many of the big deposits that are mined for copper are called porphyry copper deposits, particularly in South America, Indonesia and other places. They will be by mass half a percent, 0.6 percent copper. In the copper belts, the average deposits will be about 2 to 3 percent copper and the really high grade deposits, such as the one that we've discovered at Mangomba, will be at 5 percent to 6 percent copper.

So an order of magnitude higher in grade. And that has significant advantages, obviously, economically, but also environmentally. You can mine a much smaller footprint and produce a large volume of copper. And so it's a very attractive target for

So you're saying if someone was extracting a ton of rock, that potentially less than 1% of that ton would be usable copper? Yes. You're always going to lose a little bit in the mining and a little bit in the processing. And so you end up getting less than 1% of that mass that you've mined is your actual product. Right. George, a lot of mines today are being expanded as opposed to new mines being discovered. Why is that? It's really hard to find new mines. Yeah. So...

40, 50, 60 years ago, a lot of the earth hadn't been tested. A lot of the deposits were at surface. They might have had an expression at surface. Meaning I can see it with my eyes on the ground or just digging with a shovel? Yes. So copper, if it gets to surface, it will oxidize and form minerals that look green or look blue.

And so in the Copper Belt, for instance, there will be hills that have green staining on them. So it wasn't difficult to discover those deposits, but those have largely been found. I haven't stumbled into a green hill that's just waiting to be mined. So now we've got to start looking underneath the surface and we need a lot more tools, a lot more data. And so it's easier to expand your existing mine than spend the money to try and make a discovery elsewhere.

So who usually discovers these deposits to date? A lot of the discoveries are made by smaller companies that are really focused on just making discoveries. They're willing to take more risks. They are willing to test new technology. They're willing to look deeper or undercover or in areas that people might have turned away or had the incorrect geology approach to or the wrong model. So that attitude to exploration that drives success.

And maybe before we jump into how technology is changing mining, maybe can you share with us how has mining exploration changed over the decades? One of the stories I've always loved in mining was there was a story of how someone made a huge gold deposit discovery based off the cover of a National Geographic magazine. Because just like you said, it was being expressed on the surface. So one, two decades ago, what did exploration look like then? And then we can contrast that to today.

A lot of the work we're doing today is still the same groundwork. We're still moving onto ground. We're still mapping the geology. We're taking samples of the soil. That's been done for a long time. It's very effective. What has changed is the level of technology in terms of the geophysical methods that are available. So the ability to measure the properties of the rock.

Is it magnetic? Is one rock denser than another rock? We can measure that through what we call gravity measurements. We can use seismic surveys to try and identify the shapes of deposits deep underground. And those technologies have advanced dramatically. They've become airborne so we can fly over deposits so we don't need to build roads and bridges. We can now access the ground easily. They've become better in their resolution, the quality of the data.

But with that has come significant volumes of data. And so the ability to process and extract the value out of that data is now a challenge. Tom, tell us, how is AI being used for exploration in a way that wasn't true a decade ago?

Yeah, I think the types of data that George described are what we need to squeeze in order to have the insights that guide our exploration programs. So we might start at the continent scale, let's say satellite data across all of Australia. And we want to be able to find particular rock types that might be indicative at the surface of deposits that are very deeper.

So we can use image recognition and classification algorithms developed for other applications. We can adapt those to then apply to our specific instance of adding to insights that might lead to finding these underground deposits. But just one data source is not nearly enough. We would also take magnetic data across the entire continent. We will take whatever kinds of geochemical data

Government data sets, such as geologists who've walked around, picked up a rock and sent that rock in for chemical analysis. They're databases that are available, but extremely poorly structured with multiple analysis methods that we need to be able to clean up so that we can actually feed it into our algorithms and serve it up to our geoscientists.

We also take geostructural data. So what is the topography? Where are the mountains and what slopes are the different rock layers coming in? We can take all of that data and use that to inform the local interpretation of the geology. So that's going from the continent scale to what we call the camp scale, or roughly 10 kilometers by 10 kilometers as we narrow down the search for one of these deposits.

And then we need a whole different set of algorithms in order to go from that 10 kilometer scale to where do we actually drill to try to answer the question of what's underground. You really can't tell what's underground until you drill. And a single drill hole can cost up to a million dollars. So we want to be able to optimize where we place that drill hole. So those are some of the types of algorithms that we've built to give superpowers to our geologists.

Quality of the data is so important. And you mentioned a lot of the data that Kobold uses previously was very unstructured. Give us a taste of just how difficult it was to digitize the data to begin with and then put it in a usable format.

So very talented geologists have been walking the surface of the earth for over 100 years and collecting sometimes handwritten records, sometimes physical samples that are analyzed, sometimes hand-drawn maps, sometimes digital maps. So there are all this very diverse set of unstructured data. And these are then sometimes in government databases, either paper or digital archives,

or they are with potential joint venture partners who might have a huge pile of papers that go to date back 50 or 100 years. And there's an incredible wealth of information there, but information that hasn't been exploited because it's been locked up in these paper records. So yeah, we've had teams out scanning some of these paper records.

The job isn't done once you have a record scanned. We really want to get as much information out of this raw data as we can. And so, for example, in Finland, there's a wealth of historic data

but it's in Finnish. And so we need to be able to both translate that. And many of the words that people use to describe rocks are highly specialized. And so we need special translation modules to make sure that those come through correctly and then extract the structured data out of these unstructured reports. So for example, somebody may describe a certain rock type and a certain grain size on that rock and a certain chemistry of that rock. And we would like to take that into a table that our algorithms can then use.

So it's fascinating to me that we basically have all these geoscientists that then pair with these data scientists. How do these teams work together, given that they're coming from such different backgrounds?

We're actually fortunate that we live in the world of technology and somebody sitting in Silicon Valley is working with someone sitting here in Central Africa or in Australia. And we've been very deliberate on making sure that our data science, software engineering and our geoscience teams are highly collaborative and are paired in being able to extract the rock that we have drilled,

uploaded into the cloud and anyone around the world within Kobold can look with the same precision at the same information as if they were standing in front on the ground here in South Central Africa. We also have the abilities to actually look at the images through our different models that we're building to analyze our core. And that's something that we build within the company through the tech stack that we have.

Even just the languages, the words, how do you teach each other about your craft? If you are a scientist, a biochemist, a geologist, you're bringing together people of all different backgrounds. How do you get everyone on the same page?

One of the things we kind of do when you first join Cobalt, we have some sort of nomenclature session of what the basics mean in terms of geology and rocks, in terms of also the tech and marrying those together, like creating our own sort of internal glossary that is easy for people from backgrounds who have never been on a mine or never been around exploration and vice versa, people who have never understood the different AI models that are used, say, in the U.S.,

And that starts quite early when you're inducting a new team member. If you talk about some of the local staff we have down to community members, we've had indigenous words for copper, like the word mkuba, and we help

teach our North American or South African colleagues, like this word mucuba is copper in our local language. It's literally one language in a way. We also have a Zambian data scientist on the team and they come and spend many, many weeks on site. They get to go to a drill rig. They get to suggest many new ideas with drilling companies, drilling contractors who've kind of worked in a certain way over industry for many, many years. So we look at the rig and say, how can we be more efficient in

in extracting the score and collecting information in a manner that reduces the time to process the information. So we've been fortunate to work with contractors that allow us to trial our hardware that Tom and his team build, ship it out to Zambia,

put it next to a driller, do some basic training on how do we capture imaging of the core, like 360 imaging of the core as it's coming out of the ground, which is really revolutionary. Whereas the standard was you have to wait a couple of days, take an image, take it right, stitch it together.

And a data scientist working with a geoscientist is also getting training from a geoscientist on just the type of lithology that they see in the rock, what we're looking for and how do we make better interpretations and better predictions in a meaningful way through either a mixture of AI and HI, through all the experience of the brilliant geoscientists who've worked in industry for many, many years.

That's a great point how Cobalt is innovating on both the hardware and the software front. That's right. To feed the algorithms and the geoscientists who are going to make the next generation of discoveries of these deposits, we need to have as many data types as we can and put all of that data in front of them.

So we found some opportunities where we could push the state of the art to be able to collect more flavors of data more easily. And so one of those is with hyperspectral imaging. And hyperspectral just means many, many different colors all the way from the visible through the infrared. And what's really exciting about hyperspectral imagery is that in the infrared, you can actually measure colors.

the absorption of different molecules. And so you can actually read out chemistry using light. And we implemented that method, so hyperspectral imagery on an airborne system so that we can fly over the cobalt claims, take terabytes of data with a light aircraft, and then come back and process that data with very high spatial and spectral resolution

Add together the ground truth that geologists who've walked the ground and picked up rock samples and then scan those with infrared spectroscopy combined with this airborne imaging to really build a system that hasn't been built in mineral exploration before to be able to survey thousands of square kilometers and automatically interpret exactly what rocks are on the ground.

So compared to a hand-drawn geologic map that has a rich history, we can actually make a data-driven geologic map. That's great. And George, given that you've worked at more traditional exploration and mining companies before, maybe share some examples of how this technology or the data has surprised you.

Yeah, there have been a number of examples. Some of the countries have big data sets, and these are data sets that have been accumulated over the years from explorers in different parts of the country. Each of those explorers was looking for something specific, and so they didn't assay necessarily for everything. They didn't measure every element in every sample. They were just targeting a few.

And now we might be looking for a very specific element, and it's only available in a small portion of that data set. Normally, you think, oh, it's such a pity that we have this huge data set, but we can only use a small part of it. Whereas the data scientists will say, well, that's okay. That element that we're interested in has relationships to other elements.

And we can have a really good idea of what the grade of that element would be, given the grade of all the other elements that we know at each of the sample points. So we can test it by taking out the examples where we do have that grade. We can then estimate what that grade would be and we compare it. And that's remarkably close because we're not just comparing it to one element or two elements. We'll be looking at relationships from numerous elements.

And so suddenly this huge data set that looked like at a trunk, we're actually able to use the full value and the spread of that data. And that allows us to move into areas where other people wouldn't be. That's one way. Another way is Tom spoke about data that you digitize, maps. If I scan a map, I can look at it on a computer screen, but I have to look at it really carefully.

Now I can just look for a search term and the 12 maps that have that term will pop up and it will show me where that term is on the map straight away. And I'm able to interrogate, maybe it's the name of a drill hole or it's a certain element that I'm looking for in a report on a series of maps. And suddenly all of this information is just so much quicker to interrogate. I can spend my time applying my geological knowledge

training my experience rather than spend my time just opening and closing things. So that's a huge advantage to be able to advance the search for the new discoveries.

Hey, it's Steph. Look, we cover a lot of successful businesses here on the A16C podcast. And one common thread across every successful company, well, they've figured out marketing. But as channels are saturating and the supply of content increases by the second, it's hard to stand out amongst the noise. So with marketing only becoming harder to grok, I'm going to talk about marketing.

I look to two of the sharpest marketers in the world, HubSpot CMO Kip Bodnar and SVP of Marketing Kieran Flanagan, who host Marketing Against the Grain. They break down all the latest marketing trends and growth tactics before the masses catch on, all with a healthy dose of AI. Plus, you may even hear me on an episode or two.

So whether you're trying to grow a company, newsletter, YouTube channel, or just simply want to keep your distribution edge, check out the podcast Marketing Against the Grain, wherever you're listening now. With all of this data, how do you guys know what to prioritize? How do you decide what kind of information is more important? And then how does that guide the actual work on the field? In a world that is rich in data, that becomes the challenge, is how do you know what to actually focus on?

Some of that will come from our experience with working with data from other projects. So the geoscientists will be interacting with the data scientists saying, in this environment, we know that these factors are really critical.

And this is where the collaboration between the geoscientists and the data scientists becomes so important that it's not two separate entities. It's very collaborative and specific. And so there's no off-the-shelf option. We're not developing a tool that we can sell to an exploration company that will help them discover in any environment. Everything we're doing is tailored to the areas that we're working.

And one key aspect is also modeling the uncertainty of what's underground. And there's incredible uncertainty of what's just under the surface. And so by being able to map out the regions of high uncertainty or low uncertainty, that can also allow us to optimize where we collect the next data point. And so we can start with these publicly available or joint venture style data sets. But ultimately, we have to go to the field and collect our own data.

And I guess that uncertainty also brings us to the question of, with all of this technology, how has it improved our accuracy when we do drill? Is there a reduction that you see already in the number of drills it's taking for us to get more information?

So we want to basically quantify uncertainty and by being able to drill in an area where we'll maximize the amount of information we get, that will inform both the geoscience and data science team of what is happening within the underlying rocks is very different than, I'll say, the traditional way of, from TOPS point, you have a camp of a 10 by 10 square kilometer and you place a grid there.

Drill and hope for the best. We are very targeted on the areas that both the geoscience and data science team want to drill a hole to the angle the hole should be drilled at to what we'll call the pierce point of where we think the resource may lie.

And within a 24-month period, the level of precision has encouraged a lot of confidence, particularly on our project in Zambia. We've moved up to 10 rigs. And obviously, with each rig, we know there's a level of uncertainty attached to it, but we want to quantify that as much as possible.

So as you talk about drilling for information, then, does that mean sometimes we're drilling not just to look for the resource, but we're drilling whatever hole will give us the most information that will either confirm or deny a bunch of hypotheses? Yes. And we want to basically falsify the hypotheses quickly because you could be drilling into perpetuity, but to somebody somewhere, that's a cost.

So even if you drill and you falsify a particular hypothesis, you do not find what you're looking for.

or you affirm what you think was happening in the system. That is a lot of information that normally in traditional mining exploration, someone's like, oh, we didn't find what we were looking for. But we learned something from that particular hole. And that learning takes us back to saying, all right, scratch off hypothesis number seven. Let's come up with a new hypothesis. It's basically data-driven decision-making.

Yeah, a lot of the decisions around how to explore would be driven by what is the sort of precedent in this environment? What grid size would we be drilling? What are the neighbors drill? What's been the traditional drill spacing? Some of it might be driven by perceived regulatory requirements to reach a certain density of data. The interesting thing is that as geologists, we know

that we have a limited understanding of what's deep underground. And when you talk to one of the famous things about geologists is that they get a room of geologists together, you'll get N plus one number of opinions. You know, it's always the joke. If there's four geologists, there's five opinions. And inherently we know that, but that isn't built into the decision-making process. We aren't building models that account for all the different possibilities that we know could exist.

And so typically we will anchor on one model and our drilling and our sampling and our exploration will focus on that model. And we'll keep testing that model until either eventually we realize it's not working or we hope it's going to hold. Whereas at Cobalt, we are happy to hold multiple models at the same time.

And we will test each of those models simultaneously because you're testing the same space. But we design the drill holes to maximize how many of these models can we effectively test with each of these holes that we're drilling. Where are the specific areas that are going to solve some of the problems that we need to know about which hypothesis is valid and which one isn't?

And so actually building that in and being able to show the uncertainty and how we are reducing that uncertainty as we continue to drill is a really key focus and it's something that's very unusual in exploration. One example of applying our AI tools to lithium exploration is actually in Canada, where we knew that the right geologic processes had happened within this belt of granite.

We knew that this is the right flavor of granite that might host a lithium deposit, but we didn't know where in hundreds of square kilometers with no road access where you had to helicopter in a crew to go look at the ground where there might be signs of lithium. And

In order to investigate this very large area, the traditional way would be to drop off a field team and maybe pick them up at the end of the summer, and they will have walked across as much terrain as they could walk across and found whatever lithium they could find at the surface. That's not fast enough or cheap enough, and so we knew we could do better than that standard practice.

And so what we did was start with satellite data and start with reports across a significant fraction of Quebec about where lithium had been found previously.

And then we matched the satellite imagery with those records of lithium-bearing rocks. And we're then able to predict where, in our claims, there might be lithium-bearing rocks. So then we sent our people out in the field to either confirm or deny the existence of lithium at the places where our machine learning models were predicting there might be lithium.

And they reported back immediately via satellite link and said, guys, you just sent us to a vast field of lichen. There aren't even rocks here. Everything's covered in lichen. And that's not what we were looking for. But that let us update our models overnight so we could rerun models across thousands of square kilometers overnight with this new ground truth of what our people had actually found on the ground.

And so with the addition of both the false positives and the true positives, we were able to improve the accuracy of our model prediction by over an order of magnitude. And then in the following several weeks that we had this helicopter-supported field program, we were actually able to find spodumene, which is the lithium-bearing mineral that we were looking for. So that's an example of compressing what might have taken years of expensive remote field work into the period of a week or so by being able to iterate and update these machine learning models.

If I compare what is happening in the oil and gas space and how they marry traditional methods and technology, how does that compare with the mining space? Is mining ahead, behind oil and gas, or are there shared learnings? The technology used in the mining industry is dramatically behind what we've used to search for oil and gas.

And part of our job is to take these amazing technologies that have been developed to find fossil fuels and then adjust them so that perhaps they're smaller and cheaper so they're applicable to discovering metals rather than oil and gas. And so examples of that are directional drilling, where in oil and gas now you can process

precisely control the trajectory of exactly where you want to drill. This is new for the mining industry. We need to make this technology smaller so that it's appropriate for the kinds of breaks that we use.

Another example is geophysical techniques that were initially invented for finding oil and gas. We can adjust those to whether that's seismic imaging, whether that's electromagnetic imaging, we can adjust those so that they're suitable for finding the kinds of ore bodies we're looking for. So really it's taking tools that have been developed by other industries, such as oil and gas, or in the case of these artificial intelligence algorithms, tools that have been

and develops for image processing, we can take those and then apply them to the kinds of complex problems that we face. Oftentimes we're talking about copper, nickel, lithium. Does the approach work for other metals underground? And how do you guys think about the expanse of what this technology can be applied towards? Yeah, it definitely has applicability across any of the search spaces. The processes that are being developed are complex.

solving data problems. They are looking for controls on mineralization and you can adjust those as you're looking at a different commodity. So what's controlling a nickel deposit is very different to what's controlling a lithium deposit. This is the beauty of

not approaching a commercial software vendor to try and solve your problems, is to have the data science team and the geoscience team working so closely together to say, these are the problems in this specific environment. Even if you're thinking of nickel exploration, nickel deposits, all of them are different.

Yeah, the technology really is a toolbox that we can apply to different exploration programs around the world in multiple mineral commodities. And so the same exact tool that you'd use in Australia to find lithium is probably different from the one that you'd use to find copper in the Arctic, but they have many parallels and

When I started at Kobold, I was new to the mineral exploration industry, and I was thinking that there'd be an incredibly sophisticated way that society finds the materials that we use on a day-to-day basis. But actually, the tools in mineral exploration are shockingly primitive, and we can rapidly move beyond the state of the art in mineral exploration. I think one anecdote about the state of the industry is just how much information

It relies on looking at rocks where a good geologist can look at a rock and tell you from the context of what's around that rock, from the grain size, from the color, from the mineralogy of that rock, can tell you just so much about what has happened over the last billion years at that location.

And yet that's all done with the human eye. And so it's said that the best geologist is the one that's seen the most rocks. Well, what if we make a system that can look at more rocks than any human has ever looked at before? By just analyzing the imagery of the core that we've drilled at Mingumba, we now have nearly 100 kilometers of rock core that we've pulled out of the ground.

That would take years for a person to look at every little part of that core. And yet this is perfectly suited to machine learning algorithms that can look at millions of images in the blink of an eye. And so being able to take the real knowledge that is embedded in hundreds of years of geoscience and then apply new technologies

emerging tools to help analyze and extract real information from those techniques. I think it's just incredibly promising. That's amazing. Lots of times when I'm reading in the headlines now, I see this phrase, critical minerals. Do you guys have a sense of which critical minerals are important to national interest, for example? Or how would you define what is a critical mineral? Yeah, if you look at all the lists of critical minerals, almost every element on the periodic table is in one of those lists.

And so to me, what a critical mineral means is something that's important for our economy and our defense industrial base.

And if you look at where our economy is trending, our economy is trending towards electrification, towards electrification of everything. And so the most important critical minerals are those that allow us to electrify the economy. And the most important materials for electrifying the economy really come down to copper and lithium being the main ones. And then there's a long tail of other critical minerals beyond that.

Yeah, I think there's a lot of minerals that can perform a similar role, some just more efficiently than others. And as supply concerns or prices dictate, some can be substituted out. But some elements are just so fantastic at what they do that they are the critical minerals for electrification. Copper is just so good at transmitting electricity. Lithium is so good in batteries. And if

It's really hard to see how you can, on a large scale, remove such elements. Other considerations are elements where supply is concentrated in very small areas, things that on local or shorter timescales might become really critical. Yeah, tell me more about those. Are they concentrated in specific continents or is it even at a country level?

Rare earth elements haven't always been top of the exploration ladder in terms of what people are really interested in looking for. And so deposits will go through phases where you will discover deposits, define them, and then prices will drop. And those deposits are known about, but no one's interested in them. And then there'll be a price shock and everyone will jump back into them. And so rare earth deposits are widely spread. They are well represented in the geological records.

but they haven't been widely explored for. So lithium is actually a really good example that many, many, many years people were not that interested in lithium. It was used in very niche applications and it's only since batteries have really become so critical that suddenly people are like, wait a minute, where's the historic database on lithium deposits? Well, it's small because people haven't been focused on it. And I think some of the rare earth elements fall into those categories where for a long time they've been quite niche and now they're

are becoming a lot more important to technologies going forward. So traditionally, as a geologist, when you're thinking about what to go explore for, before it might be in terms of market size or financially, does it make sense to go explore for this given where the prices are for those metals? And now it seems like there's another driver, which could be national interest. Are there certain metals that even if the numbers don't pan out today, there might be other

incentives to build up more deposits for these other metals. Yes. And I think in the mining industry, there hasn't been a large transition of sustained demand for certain elements. And that's happening and has been in progress now for a few years and will continue. And that's quite a change from what's happened historically. We're always going to need iron ore. We're always going to need copper. But in the last few years,

Other elements have suddenly become a lot more critical than they've been in the past. And it only looks like the demand is going to grow for those elements. And there's a fundamental shift and a lot of companies are refocusing efforts into these elements that haven't had a lot of love from the exploration world for a long time. It's more complicated than just a supply and demand on an open market. There is a country competition where some of those elements might not be available in

And so that also becomes a consideration, definitely. Yeah. And that country competition and the impact on countries, what is Zambia's response to this new cobalt approach? And how has it impacted also just Africa as a whole? It's been absolutely positive. Definitely a breath of fresh air for all of us who've been in the sector here.

And generally as a continent, there is this big drive because we have this huge youthful population to drive industrialization. This is what many African governments want. And an investment like Kobold's into Zambia is stimulating opportunities, knowing that beyond what we do in exploration and eventually mining, we're actually driving the development of the youngest population on the continent.

and a lot of other trade and business opportunities, even for U.S. enterprises looking to do business in Zambia and in different parts of Africa. So it's a seed. It basically is...

getting in the door, meeting the right officials and stating the intention very transparently, very clearly and operating within the bounds of the law that we know globally. And that's quite exciting for the country, but it's also getting the neighbors waking up and saying, wait a minute, if we integrate more, there's this big project in Zambia. How do we participate in it? How do we use the Lobito Corridor, which we know will be a conduit for some of these minerals that will help us drive electrifying the world?

You're talking about a continent with a billion people, these billion people in coming decades who need all sorts of consumer items and electronics. And the U.S. gets the firsthand look into that by having access into Africa through the corridor. Just along the corridor, the population of the three countries combined is close to the U.S. population as a whole.

and growing. Even as we build these mines, how we mine, when we mine, and how much material we impact, and even how we're able to look at the environment through the mining process is going to rapidly transform basically on everything that we're doing with the information we have and how we can analyze it statistically. So mines of the future are also going to be fundamentally different. I know we talked about exploration

But as earlier said by Connie, the image of mining has been poor in past decades and something we want to do is change the image of mining. And that change will come to how we do a lot more things with more prediction, more precision, even as we build out many, many projects. And that basically becomes institutionalized in the industry.

I think from my perspective, the industry is perceived as quite an established, mature industry. And from a geology perspective, a lot of the easy deposits, the perception is they've been found and that it's only going to get harder. It doesn't sound like a good marketing pitch, but the reality is actually this time now is a

amazing time to be in exploration the ability to take new technologies and apply them to solve the problems and knowing that you're absolutely critical to ensuring that we can solve the problems that we need to solve globally if we don't do our job properly we're going to slow down the ability to solve problems yeah that sort of focus has been missing i think from the industry for a long time and it's awesome to be part of that now

All right, that is all for today. If you did make it this far, first of all, thank you. We put a lot of thought into each of these episodes, whether it's guests, the calendar Tetris, the cycles with our amazing editor, Tommy, until the music is just right. So if you like what we've put together, consider dropping us a line at ratethispodcast.com slash A16Z. And let us know what your favorite episode is. It'll make my day, and I'm sure Tommy's too. We'll catch you on the flip side.