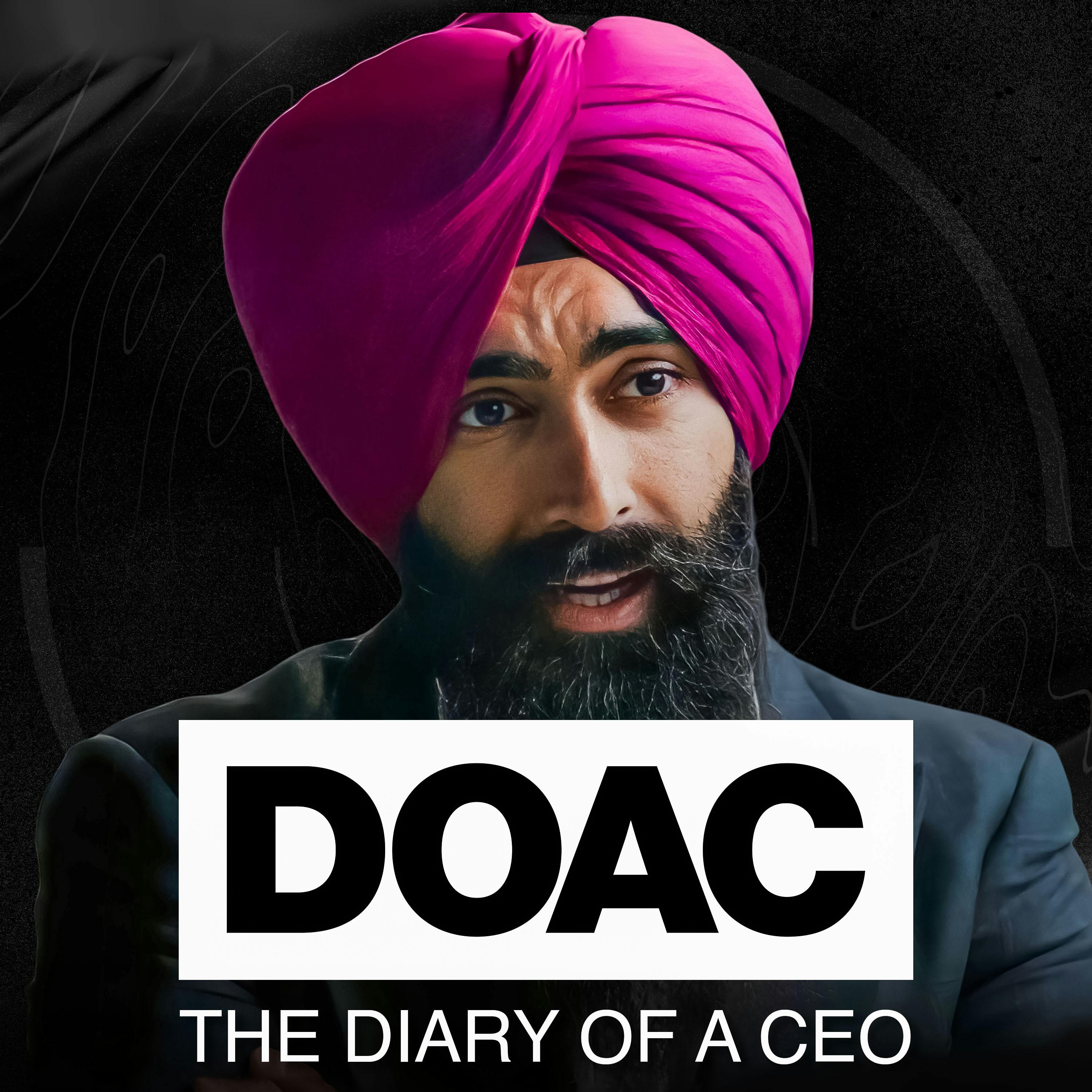

The Savings Expert: Are You Under 45? You Probably Aren’t Getting A Pension! Do Not Buy A House! This Is Probably Why You’re Broke! - Jaspreet Singh

The Diary Of A CEO with Steven Bartlett

Deep Dive

Why is it important for people to understand how money works?

Understanding money is crucial because it allows you to win in the economic system. Wealthy people don't get rich by working for a raise or climbing the corporate ladder; they understand how money works and how to grow their assets. Without this knowledge, you're likely to stay in debt, pay higher taxes, and struggle to build wealth.

Why shouldn't people buy a house they can't afford?

Buying a house you can't afford is risky because it turns your home into a liability rather than an asset. You'll be paying more in mortgage interest, property taxes, and maintenance costs than you would in rent. Additionally, if you can't afford the house, you won't have money left to invest in other assets that could generate wealth.

What is the opportunity cost of buying a house?

The opportunity cost of buying a house is the potential returns you miss out on by not investing that money elsewhere, such as in rental properties, stocks, or starting a business. Housing prices don't always go up, and you could lose the opportunity to grow your wealth through other investments.

How can people get out of the paycheck-to-paycheck cycle?

To break out of the paycheck-to-paycheck cycle, you need to stop spending all your money and start saving and investing. This means cutting back on unnecessary expenses, selling assets you can't afford, and using any extra time to learn and earn more money. It's about sealing the holes in your financial boat to stop the bleeding.

Why is it important to have a money mindset?

A money mindset is crucial because it shapes your beliefs about wealth and your ability to achieve it. If you don't believe you can become wealthy, you won't take the necessary actions to build wealth. A positive money mindset involves understanding that money is a tool, that it is abundant, and that it is your duty to become wealthy to take care of yourself and your family.

What role does cryptocurrency play in Jaspreet's investment portfolio?

Cryptocurrency is part of Jaspreet's speculative investments, which make up about 18% of his portfolio. He views crypto as a high-risk, high-reward asset and advises against putting long-term investments into speculative assets like crypto, especially if you're living paycheck to paycheck.

What is the retirement crisis, and why does it matter?

The retirement crisis refers to the lack of adequate savings and pensions for a large portion of the population entering retirement. This crisis matters because it affects the financial stability and quality of life for retirees. Without sufficient savings, retirees may struggle to cover living expenses, healthcare costs, and other necessities.

What is Jaspreet's best investment ever?

Jaspreet's best investment is the investment in himself through education and personal development. This has provided better returns than any real estate, stock, or cryptocurrency investment. He emphasizes the importance of learning and making mistakes as part of the growth process.

Why is patience a critical factor in wealth creation?

Patience is critical in wealth creation because it allows you to take a long-term view on investments. The stock market, for example, has historically grown by an average of 10% a year. By being patient and consistently investing, you can build significant wealth over time without the risks associated with short-term trading and speculation.

- Money is used every day for basic needs like eating and feeding others.

- Most people are never taught about money, leading to misconceptions and financial struggles.

- Understanding money is crucial for winning in the economic system.

Shownotes Transcript

Revealing what hedge funds and multinational banks don't want you to know about building wealth! Jaspreet Singh is spilling secrets and helping everyday people find financial freedom

Jaspreet Singh is an entrepreneur, former attorney, and financial educator. He is CEO of Minority Mindset Companies and host of the 'Minority Mindset' finance and entrepreneurship YouTube channel.

In this conversation, Jaspreet and Steven discuss topics such as, the impact of spending more than you earn, how to clear credit card debt, why you shouldn’t buy a house, and the 75/15/10 plan to become rich.

(00:00) Intro

(02:14) Who Should Care About Jaspreet's Message And Why?

(03:21) Figuring Out Wealth: Key Differences Between The Wealthy And Everyone Else

(08:11) Jaspreet's "Penny Drop" Moment: When It All Made Sense

(13:03) Lessons From Starting Early In Business

(17:48) Should You Buy A House Or Rent?

(24:20) Understanding Opportunity Cost In Financial Decisions

(26:28) Is Rent Really Throwing Money Away?

(28:13) How To Know If You Can Afford A House

(30:59) Do You Know What You're Really Spending?

(32:51) Showing Wealth vs. Hiding Wealth: Which Is Better?

(38:04) How To Stop Living Paycheck To Paycheck

(44:20) Why Sacrificing Can Be So Hard

(47:12) Life Struggles And Reckless Financial Decisions

(50:17) Jaspreet's Thoughts On Cryptocurrency

(55:52) Developing A Money Mindset For Success

(59:45) Negative Stereotypes That Hold Us Back From Achieving Success

(01:03:05) The "9 Dots" Trivia: Thinking Outside The Box

(01:08:50) Facing Barriers On The Path To Financial Freedom

(01:11:14) Escaping Financial Barriers: Actionable Steps

(01:13:36) Do You Need To Remind Yourself Of Your Mantra?

(01:16:34) Money Is A Tool: What Does That Really Mean?

(01:20:37) Why It's Important To Recognize Abundant Financial Opportunities

(01:22:50) Why It's Your Duty To Become Wealthy

(01:23:56) Should We Change Our Investments With Trump In Power?

(01:27:50) How To Get Started With Real Estate Investing

(01:30:12) Jaspreet's Best Investment Ever

(01:35:03) Choosing The Right People: Steve Jobs' Valuable Lesson

(01:43:29) The Power Of An Internal Locus Of Control

(01:50:18) Elon Musk's Tax Efficiency And Loaning Against Assets

(01:54:47) Understanding The Retirement Crisis

(01:56:23) How Much Money Do You Really Need To Retire?

(02:02:24) Solutions To The Retirement Crisis

(02:10:31) Principles For Success In Business

(02:15:26) Be Boring And Patient: The Key To Winning In The Money Game

(02:19:52) Best Places To Gain Knowledge And Skills

(02:21:42) What's The Most Important Thing We Didn't Discuss Today?

(02:22:52) The Last Guest Question

Follow Jaspreet:

Instagram - https://g2ul0.app.link/UZG34SJiGOb)

Twitter - https://g2ul0.app.link/32z1S6LiGOb)

YouTube - https://g2ul0.app.link/G33HmeOiGOb)

🤐👀 The 1% Diary is almost here - make sure you're ready!!** **https://bit.ly/1-Diary-Waitlist-Megaphone-Ad-Reads)

Watch the episodes on Youtube - https://g2ul0.app.link/DOACEpisodes)

Follow me:

https://g2ul0.app.link/gnGqL4IsKKb)

Sponsors:

Linkedin Ads - https://www.linkedin.com/doac24)

PerfectTed - https://www.perfectted.com) with code DIARY40 for 40% off

Learn more about your ad choices. Visit megaphone.fm/adchoices)