Key Insights

Why should regular people avoid investing like billionaires?

Billionaires focus on wealth preservation, use private deals, have high risk tolerance, can absorb losses, use other people's money, influence markets, and don't need diversification, which are strategies unsuitable for most people.

What are some strategies billionaires use for wealth preservation?

They use trusts, charitable donations, and estate planning tools to protect their wealth from high taxes and ensure it's passed down according to their wishes.

Why can't regular people access the same investment opportunities as billionaires?

Billionaires have access to private equity and venture capital deals, which are exclusive and not available to the average investor due to high risk and limited accessibility.

How does Elon Musk's risk tolerance differ from that of regular investors?

Elon Musk can afford to take high risks like buying Twitter and losing billions because he has vast wealth to absorb such losses, unlike regular investors who would be significantly impacted.

What is the key difference in how billionaires and regular people use debt for investing?

Billionaires use their investments as collateral to borrow money for further investments, while regular people should avoid debt and invest using their own money to keep it simple and risk-free.

Why is diversification crucial for regular investors?

Diversification spreads risk across different investments, protecting against significant losses if one investment fails, which is less critical for billionaires who have other layers of wealth.

What is the recommended investment strategy for regular people?

Invest 15% of gross income into tax-advantaged retirement accounts like 401k or Roth IRA, focusing on mutual funds like growth, growth and income, aggressive growth, and international to diversify and reduce risk.

Chapters

- Billionaires focus on wealth preservation, not growth.

- They have access to private equity and venture capital deals unavailable to the average investor.

- Billionaires can afford high-risk investments and absorb significant losses.

Shownotes Transcript

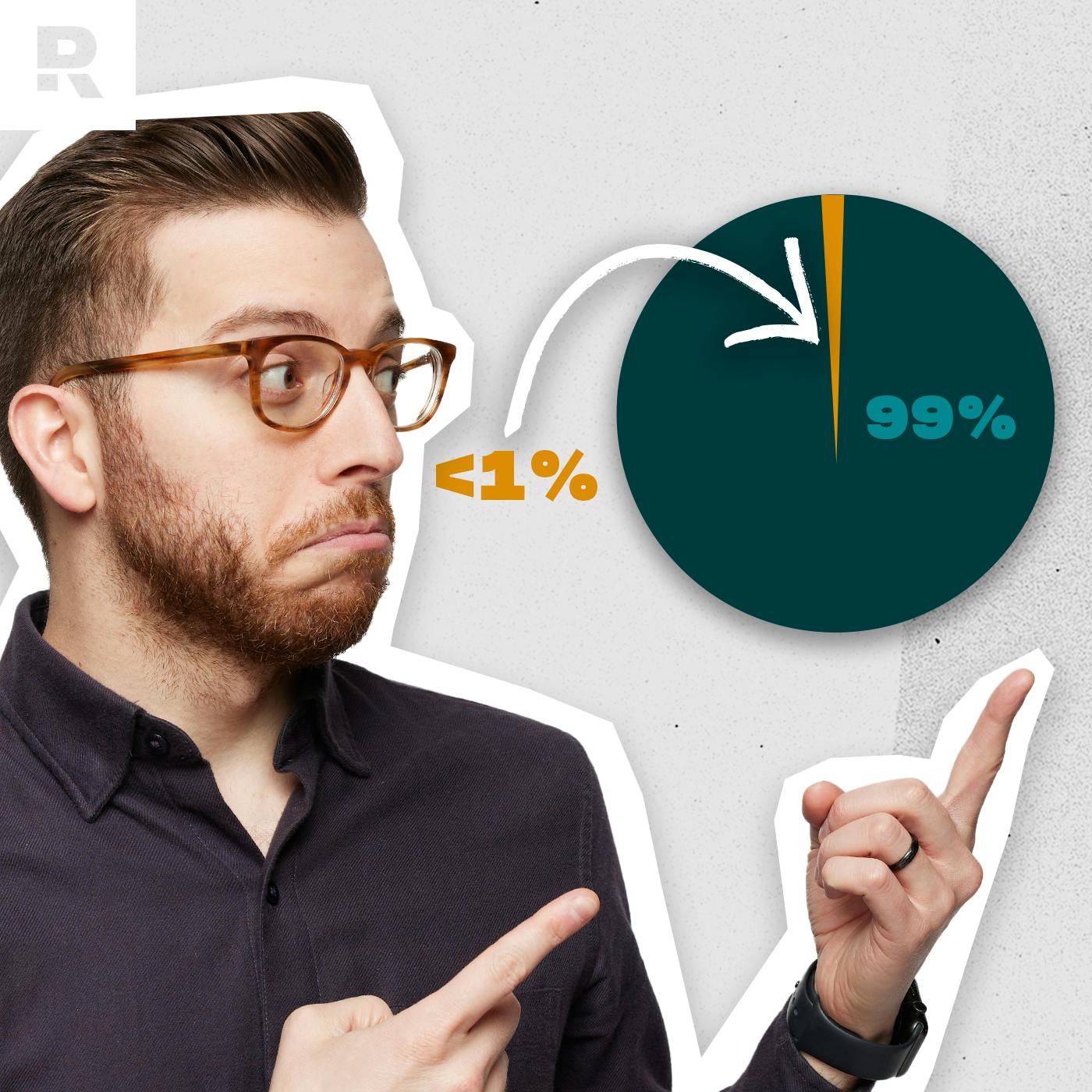

Hey guys, the Ramsey Christmas Cash Giveaway is here and we are giving away thousands in cash. Go to ramseysolutions.com slash giveaway to enter for your chance to win. It's free money. What are you waiting for? ramseysolutions.com slash giveaway. There are 756 billionaires in the US and the odds are you're not one of them. What are the odds here? 0.0000002% chance. So you're telling me there's a chance. Slim. But when it comes to handling money, why not take a cue from the people that have the most of it?

Well, in this episode, I'll tell you exactly why not. Because today we're covering seven reasons you should not invest like a billionaire and what you should do instead to build some more realistic levels of wealth. But first, the fastest seven reasons you should hit that like and subscribe button. It's free. It's easy. Quality money knowledge. You'll never miss a tip. Your friends will thank you. You're already here. Might as well. And because why not? Now, to be clear, a

billion is 1,000 million. So even if you have a million dollars, you're just 0.1% of the way there. Numbers can be depressing.

Now, there's some good reasons why investing like a billionaire may not be the best idea for most people. But here's some good news. You don't need to have a billion dollars to have a great life, and therefore, you don't need to do what billionaires do. Here's why. Number one, billionaires focus on preserving wealth, not growing it. So they use complicated tax strategies and estate planning tools and probably have massive teams that help them with all this stuff. Here's a couple examples. Billionaires often put their money into trusts, which are legal setups that help protect their wealth from high taxes and high taxes.

and ensure that it's passed down to their kids and grandkids according to their wishes. They might also use charitable donations to reduce the amount they owe in taxes and also to, you know, support causes they care about, like the Belgian nonprofit, Apopo, that trains rats to sniff out landmines and tuberculosis. Apparently, we have been under utilizing rodents and New York City, I think we have a solution to your rat problem. These methods aren't as much about growing their wealth, but about preserving it because they've already built their fortunes. So now they focus on long term protection.

Now, for us regular people, we are more interested in strategies that it takes to grow wealth. Plus, we really don't have enough money for these preservation strategies to really make a dent. Number two, billionaires have access to private deals. We're talking private equity or venture capital. What the heck is that? Well, think of private equity as the big leagues for established companies that need a makeover. Like those TV shows like The Profit where someone comes in, buys a struggling business, turns it around, and then sells it for a profit. I see what they did there. Clever name, Marcus. Good work.

Yeah, but it's really good. So private equity firms raise a ton of money, usually from big investors. They buy up companies and they try to make them more valuable by cutting costs, improving operations or changing leadership. Then they sell the company or take it public to cash in on the higher value. Now, venture capital is a little more like Shark Tank, but for startups. It's for companies that are brand new and high risk, but could blow up like a scrub daddy or a squatty potty.

If the startup succeeds, they make massive returns. And if it tanks, well, billionaires can afford to take that hit. We can't. - I am never gonna financially recover from this.

And that's why it would be far too risky to invest your money like billionaires do. Plus, many of these opportunities are not available to the average George. So you literally can't replicate their success in these spaces because you don't have the same level of access to these deals. Number three, billionaires have a higher risk tolerance. Along the same lines, when you've got billions, you can stomach high-risk investments like tech startups or hedge funds. And to be clear, hedge funds are like the high-stakes casino of investing. They can invest in anything, stocks, bonds, real estate, and even bet against things, a.k.a.

hedging. And this is super risky because they often borrow tons of money to get huge returns. And if it works, great. And if not, billionaires can handle the loss. And again, you can't. Plus, hedge funds are super exclusive and charge high fees, kind of like your college fraternity minus the paddles and toxic masculinity. Number four, billionaires can absorb losses. They can lose millions without affecting their lifestyle. There's still going to be plenty of jets and yachts being bought. Don't you worry.

And a perfect example of a higher risk tolerance is Elon Musk buying Twitter. He bought it for $44 billion in 2022. But after the changes he made, like renaming it X like an early 2000s emo teen, advertisers left, causing Twitter's X's value to drop about $20 billion, which is a pretty significant loss. But as you've seen, Elon's doing just fine. He's still rolling out Teslas, sending rockets to space, and raising kid number 12.

And to be honest, I'm not sure if that's referring to his 12 kids or if he just named a kid number 12. It's anyone's guess. Think of it this way. If someone with a billion dollars loses 99% of their money on an investment, guess what? They would still have $10 million. If you lose 99% of your money, you're left with a couple of linty pennies and a sandwich, if you're lucky.

Even if you had $100,000 and you lost 99% of your money, you'd only be left with $1,000. So ultimately, a significant loss in your portfolio could mean postponing retirement or having to rethink your entire life. You don't have the same cushion to take big risks. Number five, billionaires use other people's money.

Another huge advantage billionaires have is the fact that they've got an endless lineup of wealth managers and banks ready to hand them unlimited cash at stupid low rates whenever they need it. Now, for the average person, investments don't have any spending value until, you know, you sell the investment. It's like the Beanie Babies your Aunt Sandy is still holding on to. A lot of value back in 99, and if Sandy had sold them, she'd be rolling in the dough. But she didn't, so now she's just a weird aunt with a bunch of bean-filled animals. I'm willing to be the president.

of a Beanie Babies Anonymous. So in order to avoid selling their stock, billionaires will often borrow the money from one of these banks or wealth managers and use their investments as collateral. Now, if you know me, I never, ever recommend borrowing money, even if you're a billionaire. But it is a strategy they often use that affects how they can invest. But for the rest of us, keep it simple. Invest consistently, avoid debt,

and always use your own money. Number six, billionaires have influence over markets. Basically, if a billionaire says something is a good bet, people are gonna pay attention, which means how they invest and what they say publicly can shift markets. Let's look at another example from the richest person in the world, Elon Musk.

In May of 2020, Elon tweeted, "Tesla stock price is too high, IMO." Bold strategy, Cotton. Let's see if it pays off for him. The tweet caused Tesla stock to drop almost 10% in one day, wiping out around 15 billion from Tesla's market value and almost 3 billion from Elon's net worth. - It was a very small number. - Why does Elon do what he does? I have no idea. We may never know. But either way, you won't have that same kind of pull in the market. So you're playing a very different game with a different set of rules. When I tweet, I'm lucky if I get one heart from my mom.

And number seven, diversification isn't as critical for billionaires. Billionaires can afford to concentrate their efforts on certain industries or companies because they have other layers of wealth to fall back on. But for the average investor like you and me, diversification is the key. You don't want to invest in any one thing that could fail. It's better to cast a wider net. What does that look like? Well, you should be investing in solid growth stock mutual funds that protect your growth and reduce your risk. In a second, I'll tell you what four types I recommend. Oh, what? Come on, guys. Really? Really?

I shouldn't.

A super detailed report. I'm so sick of scams. Now I'm a fan and getting way less spam. You won't regret joining. Delete me.

Go to joindeleteeme.com slash george and get 20% off on any of their plans or click the link in the description below. Man, the late 90s, what an era for music. It gave us hits like Kiss Me, All Star, and Save Tonight. And speaking of savings tonight, Laurel Road is another sponsor of today's episode. And if you aren't taking advantage of their high-yield savings account that offers over 4% APY, you are living la vida loca.

it will make you feel like you found a genie in a bottle because there's no minimum balance required, no sneaky fees, and your deposits are FDIC insured. So if you're saying I want it that way, then may click a Google doll and slide on over to laurelroad.com slash George or click the link in the description below. So if doing what billionaires do won't work for you, then how should you invest? It's simple. Invest like a millionaire, not a billionaire.

And I'll tell you how. But first, you've got to make sure you're ready to invest in the first place. If you've got debt hanging over your head or you don't have three to six months of expenses saved up, pump the brakes on investing for now. And here's why. Your income is your secret weapon to building wealth. And if you're busy paying off debt or you don't have an emergency fund, you don't have the margin left over to invest. If an unexpected expense pops up, you could go further into debt or rob your investments to cover it. And poof, your progress is gone.

So when you're ready to start investing, you want to be putting 15% of your gross income into tax advantage retirement accounts like a company 401k or a Roth IRA. And here's my five word investing hack. Match beats Roth beats traditional. Here's how it works. If you get a 5% match from your employer, start investing there to get the company match. Remember, you need to invest 15% of your income regardless of the match.

So after your match, take advantage of all the Roth options you can at work or as an individual. Roth just means that you pay the taxes now instead of later, which also means the money grows tax-free and you can withdraw it tax-free in retirement. It's a beautiful thing. So if you have a Roth 401k at work, great. You can invest your entire 15% there if you've got solid funds and low fees.

If not, you can max out a Roth IRA for yourself. And if you're married, your spouse as well. And if you still haven't hit 15% at that point, you can go back to traditional options like your 401k, 403b or TSP until you get to that 15%. Now, remember, you have to actually buy funds inside of those accounts in order to be investing. What funds? I recommend diversifying across four types of mutual funds. Growth,

growth and income, aggressive growth, and international. Now, you might see these listed as large cap, mid cap, small cap, and international. Now, cap here stands for market capitalization. These funds focus on companies expected to experience above average growth compared to others in the market. So while they may be more volatile in the short term, they have the potential for higher returns over the long haul, which makes them a great option for retirement investing. Now, I do as I say, this is the strategy that

I personally use and recommend, but you don't have to take my word for it. According to the largest study ever done on millionaires, eight out of 10 millionaires said that investing in their company's 401k plan was the key to their financial success. And that same study found that millionaires didn't risk their money on single stocks or

an opportunity they couldn't pass up. In fact, no millionaire in the study said that single stock investing was a big factor in their financial success. It didn't even make the top three list of factors for reaching their net worth. So don't try and get fancy or blindly throw darts at a board. Stick to proven investments and just invest regularly. That's the key. You want to be a crockpot in a world full of microwaves. If you want to build wealth and keep it, do it nice and slow. And if you want to learn more about how to invest like a millionaire, check out this deep dive on the investing method that's worked for the

thousands of millionaires, or click the link in the description below. Thanks for watching. We'll see you next time.