Key Insights

Why should regular people avoid investing like billionaires?

Billionaires focus on wealth preservation, use private deals, have high risk tolerance, can absorb losses, use other people's money, influence markets, and don't need diversification, which are strategies unsuitable for most people.

What are some strategies billionaires use for wealth preservation?

They use trusts, charitable donations, and estate planning tools to protect their wealth from high taxes and ensure it's passed down according to their wishes.

Why can't regular people access the same investment opportunities as billionaires?

Billionaires have access to private equity and venture capital deals, which are exclusive and not available to the average investor due to high risk and limited accessibility.

How does Elon Musk's risk tolerance differ from that of regular investors?

Elon Musk can afford to take high risks like buying Twitter and losing billions because he has vast wealth to absorb such losses, unlike regular investors who would be significantly impacted.

What is the key difference in how billionaires and regular people use debt for investing?

Billionaires use their investments as collateral to borrow money for further investments, while regular people should avoid debt and invest using their own money to keep it simple and risk-free.

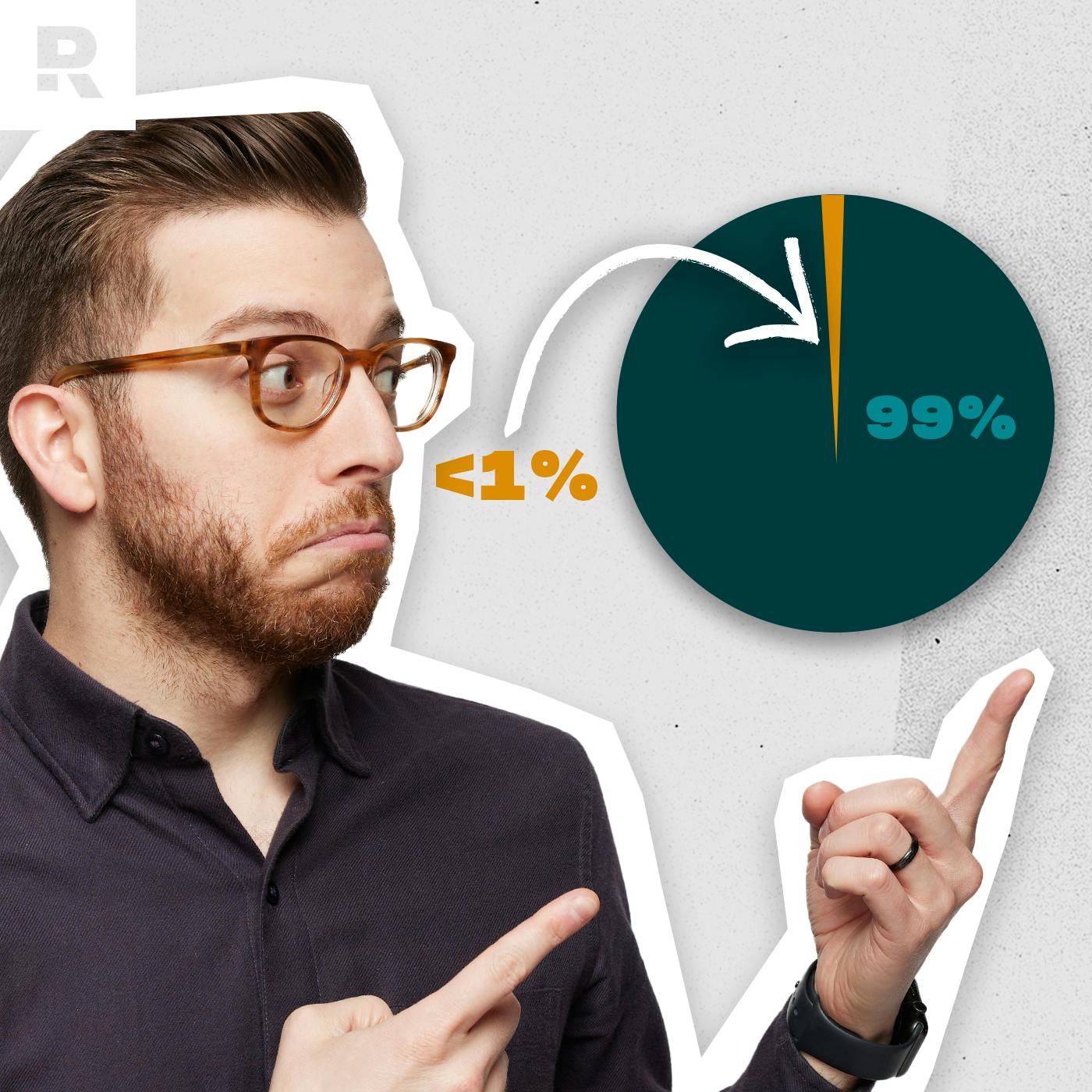

Why is diversification crucial for regular investors?

Diversification spreads risk across different investments, protecting against significant losses if one investment fails, which is less critical for billionaires who have other layers of wealth.

What is the recommended investment strategy for regular people?

Invest 15% of gross income into tax-advantaged retirement accounts like 401k or Roth IRA, focusing on mutual funds like growth, growth and income, aggressive growth, and international to diversify and reduce risk.

Chapters

- Billionaires focus on wealth preservation, not growth.

- They have access to private equity and venture capital deals unavailable to the average investor.

- Billionaires can afford high-risk investments and absorb significant losses.

Shownotes Transcript

💵 Start your free budget today. Download the EveryDollar app!)

So, you want to be a billionaire, huh? Well in this episode, find out seven reasons why you* shouldn’t *invest like a billionaire and what you should do to build wealth instead.

**Next Steps: **

- 🎥** **Watch my video Investing for Beginners).

Connect With Our Sponsors:

🔒 Get 20% off when you join )DeleteMe).

💸 Learn more about opening a high-yield savings account with )Laurel Road).

Explore More From Ramsey Network:

🍸 Smart Money Happy Hour) 💸 The Ramsey Show Highlights)

📈 The EntreLeadership Podcast)